Last week we got the interesting and unusual news that the Federal Reserve did not increase its benchmark rate and suggested that rates would not increase this year. While the Fed doesn’t set mortgage rates, whatever it does has an impact on them.

The Fed’s decision on whether to increase, decrease or leave rates alone is based on many factors. From the growth of the US economy to economic indicators from global markets like Europe and China, the Fed is looking at a number of indicators.

What the decision to leave rates alone suggests is that the Fed is getting more mixed data around the overall health of key consumer markets. Now, what does it mean for home buyers? I discussed this with Dobi Real Estate Agent Ross Rossan (below).

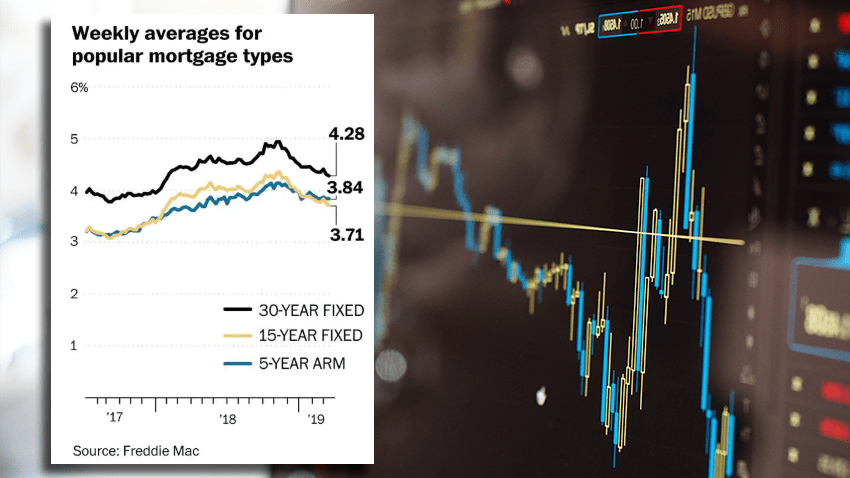

From a rates perspective that have been dropping steadily since Fall 2018 and the current rates still haven’t responded to the Fed’s news. I would expect that the rates drop even more as the fallout of the Fed’s decision becomes more understood.

So as rates continue to lower, financing a new home becomes more and more attractive. The problem becomes an increase in competition among buyers. I’ve heard multiple agents tell me that the buying season is already heating up with multiple offers coming in on homes throughout the Metro Detroit market.

My advice to home buyers is to consider moving beyond consideration and start getting more aggressive with the home buying process. When you think about the fact that mortgage rates are at a 14-month low and dropping, and the Spring buying season has arrived, more buyers are going to come onto the market to take advantage of these rates.

When you go out and look at homes you need to understand your budget, have an agent that will help you along the way, and a pre-approval letter so you can move fast in a market where you’ll likely compete with other offers on the houses you like/want.