Rates Have Gone Up in 2022… What Should You Do Now?

Rates have gone up in 2022. Were you planning on making any moves in the housing market? Don't let the rates stop you now. While it is true that the rates have spiked a bit, investing is still...

What Should I Do With Equity Built in My Home? We Have the Answer

Many have gained a lot of equity in their homes, but what now..? It's important to have a loan officer guiding you through what you can do with this built equity. You have to start somewhere. One of...

Mortgage Recasting – Is it Right for You?

Is mortgage recasting right for you? Is recasting something you should even consider? To recast a mortgage means to make a lump sum payment to the overall balance of the loan in question. The...

What 2021 Inflation Means For Insurance Rates

It's no secret that inflation is a serious issue right now, but what does that mean for interest rates? How does inflation affect them? This is really important information right here, Paul explains...

Is A 15-Year Mortgage Right For You? – The Benefit Factor and More

If you are considering a 15-year mortgage or don't know if it's right for you, let us help. There is a huge benefit to choosing a 15-year mortgage versus a 30-year. This benefit is definitely...

Is the Housing Market Bubble Going to Pop?…If There Even is One

Is there a bubble in our housing market? If so, is it ever going to pop? A lot of people seem to think there is a bubble, but we are on the other side of the argument. What do you think? Paul...

Why Are Appraisals Taking Longer? What’s the Effect?

The word is going around that appraisals are taking longer...but what are the effects of this? 2021 has been insane in terms of the housing market. If you are buying a home, this affects you and...

Bill Dallas, Finance of America Mortgage┃Inside Real Estate

Bill Dallas is President of Finance of America Mortgage, leading the business operations and strategic vision for FAM and all of its businesses. Bill is known for building two mortgage companies...

How To Win An Offer On Your Dream Home

Wondering how to win an offer on your dream home? It is a competitive market, to say the least, so why not give yourself the best chance at winning your dream home? One of our owners here at Omega...

What Should A Good Mortgage Experience Look Like?

A good mortgage experience is something you deserve. Here at Omega Lending, we will always provide you the mortgage experience you are looking for. One of our owners, Paul Apostolakis, explains what...

Samantha Hillery, Motus Real Estate┃Inside Real Estate

Through her fresh perspective and keen insights into the local real estate scenery, Samantha strives to provide outstanding representation and trusted guidance throughout each process. She talked...

Edna Keep, Edna Keep Real Estate Coaching┃Inside Real Estate

Edna Keep’s journey from single mom at age 16 – living in subsidized housing with a daughter in subsidized daycare - to multi-millionaire Real Estate Entrepreneur and Coach inspires others. Her...

Why Should I Choose A Broker for My Mortgage Transaction?

Mortgage brokers are better for consumers looking to get a home loan. The question is "why"? From their resources to their ability to serve you a stronger client experience, a broker is the way to...

Willie Davis, Perks by Perk Real Estate, Re/Max Eclipse┃Inside Real Estate

Willie J. Davis is a licensed REALTOR@ and a certified Seller Representative Specialist (SRS) in Michigan and Georgia serving clients in the metro Detroit area as well as Atlanta. Willie has been in...

Avery Carl, The Short Term Shop – Episode 159┃Inside Real Estate

Avery purchased her first investment property at the age of 26. She currently holds a portfolio of 19 properties. In 2017 Avery left her corporate marketing job to focus full time on real estate,...

How Much Should I Put Down On A House Right Now?

You're probably wondering "how much should I put down on a house" especially right now. It all depends on the loan type and your capabilities. Our founders get down to the surface and explain how...

Khash Saghafi, Liberty Home Mortgage Corporation – Episode 158┃Inside Real Estate

Khash Saghafi has been an industry professional for over 16 years and has always specialized in residential mortgage loans. He is a nationally renowned speaker in the mortgage industry and has been...

When is My First Payment Due on My Mortgage After I Close?

When is your first payment due after you close on your mortgage. This is often an answer that gets confused. You have to take interest into account and the date as well. Our founders explain the...

Simon Thomas DOBI Real Estate – Episode 157┃Inside Real Estate

Simon Thomas is the Chief Executive Officer of DOBI Real Restate. In the summer of 2018, Simon launched his own real estate brokerage, with a vision to offer realtors the services needed to enable...

Tonya Eberhart, BrandFace – Episode 156┃Inside Real Estate

Tonya is the founder of BrandFace® and Branding Agent to Business Stars. She’s also the author of four books on personal branding. Tonya’s humble career began while selling vacuum cleaners door to...

Purchase Applications are Down – Is the Market Softening Up?

Purchase applications are down and the market is softening up. We are even seeing price drops that we weren't expecting. Is it because of the weather? Or maybe it's because of the COVID-19 pandemic...

Omega Lending Group – Episode 155┃Inside Real Estate

The founders and owners of Omega Lending Group answer some hot questions in the mortgage world. We discuss calculating mortgage payments, pre-approvals/pre-qualifications, getting your credit pulled...

Brennen Clarke, Mark Z Real Estate Experts – Episode 154┃Inside Real Estate

Part of the Mark Z team, we were excited to have Novi real estate agent Brennen Clarke on the show again. Brennen puts a lot of emphasis on video marketing and other digital channels to help sell...

Is Private Mortgage Insurance (PMI) Bad? Should I Get It?

Is PMI bad? When you are looking to get a mortgage PMI might be something to consider. Our founders discuss why PMI isn't so bad and how you can put yourself in a good financial position. Find out...

Sheel Sohal, Luxury Homes International – Episode 153┃Inside Real Estate

Our guest this week was Sheel Sohal, is Keller Williams ranked #1 individual real estate broker representing clients and properties locally in the Metro Detroit market. Focused on pre-planning,...

The Omega Boys, Omega Lending Group – Episode 152┃Inside Real Estate

The owners of Omega Lending Group answer pressing mortgage questions from the audience. They touch on inflation, PMI, how much to put down on a house, credit score requirements and more. Watch now!...

What Sellers Look for in an Offer – How Do You Stand Out In This Market?

When buying a home, it's hard to pin down what sellers look for in this market. Most homes are facing multiple offer situations. How can you stand out among other buyers? What can you include in...

Erik Wright, Social House Real Estate Group – Episode 151┃Inside Real Estate

Our guest this week was Erik Wright, Co-Founder and Realtor of Social House. Social House Group was started in 2019 to further scale the strategy and teach other agents how to implement the same...

Your Home Equity and Inflation in the Market – When Does it End?

Home equity and inflation in the market have been two hot topics recently. Why is it important to have refinanced? Where are we seeing the inflation? When will we see a proper correction? Our...

Jon Reusch, Keller Williams Lakeside – Episode 150┃Inside Real Estate

Jon Reusch is a servant leader, who prides himself on the success of those around him. As Operating Principal (OP) at Keller Williams, he is humbled at the opportunity to lead others with integrity,...

Ali Berry, Quest Realty – Episode 149┃Inside Real Estate

Broker and Owner of Quest Realty, Ali Berry, joined us this week. He is very knowledgeable and we were excited to hear how his growing business has been navigating through the market. He talks about...

Jumbo Mortgage – Everything You Need to Know

A Jumbo Mortgage and Super Jumbo Loan are options for home buyers that need a loan with an amount that exceeds the limitations set forth by government-sponsored entities. In other words, when a loan...

How Does A Reverse Mortgage Work? – What You Need to Know

A reverse mortgage allows people who are 62 or older to leverage any equity in their homes. A homeowner has the ability to withdraw an amount of home equity without ever needing to repay it, with a...

Craig Joeright, DOBI Real Estate – Episode 148┃Inside Real Estate

This week our guest is Craig Joeright of DOBI Real Estate. Before Craig became a Real Estate professional, he was a competitive figure skater for the United States. After 30 years of being in the...

Kris Reid, Ardor SEO – Episode 147┃Inside Real Estate

Kris Reid is a known business growth specialist for Ardor SEO & Real Estate Masters Summit. He is the CEO and Founder of Ardor and has been named "the coolest guy in SEO". He talks about how he...

Mat Ishbia, United Wholesale Mortgage – Episode 146 ┃Inside Real Estate

Mat Ishbia was our guest this week! It's no secret that UWM has been in a "crosstown war" with Quicken Loans. UWM no longer does business with brokers who work with QL. What has this meant for...

Mortgage Tips for Newlyweds – Special on Channel 7

Here's our own Paul Apostolakis discussing mortgage tips for newlyweds. Whether buying a home, or refinancing, here's some insight Paul shared during The Ultimate Wedding Show on WXYZ-TV Channel 7....

Kevin Keck, Simpli Real Estate – Episode 145 ┃Inside Real Estate

Kevin Keck is the CEO/Founder of Simpli Real Estate. With over 11 years of experience as a Certified Residential Appraiser, Kevin has completed over 10,000 appraisals ranging in value from $5,000 to...

How much house can I afford?

There are many factors that impact your ability to buy a home and the budget that you can afford. Everyone’s financial situation is different and when it comes to buying a house. It's important to...

Omega Lending Group – Episode 144┃Inside Real Estate

The mortgage professionals from Omega Lending Group, a finalist in the Detroit Best of the Best Mortgage Lender for 2020 discuss the current market, UWM contracts, rates and refinances, and more....

5 First Time Home Buyer Mistakes to Avoid

There are mistakes you should avoid If you are a first-time homebuyer. It's easy to get excited and rush the process, but it's important to do your research. You wouldn't want to regret your...

Brian Vieaux, FinLocker – Episode 143┃Inside Real Estate

Our guest this week was Brian Vieaux, President of FinLocker. Brian has over 25 years of bank lending and mortgage experience. Join us as we discuss UWM versus Quicken Loans, Zillow getting sued,...

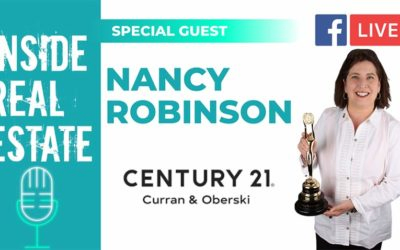

Nancy Robinson, Century 21 – Episode 142┃Inside Real Estate

On this week's episode we had Nancy Robinson, the #1 Realtor at Century 21 Curran & Oberski - Royal Oak and in the Great Lakes Region, #12 in the United States, and #17 in the global Century 21...

Mark Shaftner, Keller Williams – Episode 141┃Inside Real Estate

Mark Shaftner of Keller Williams offers his insight on mortgage application volume decline, home prices gain, and stock market corrections. Always a great discussion with Mark. Watch now! Rather...

4 Smart Ways to Invest Your Cash-Out Refinance

A cash-out refinance is the best option for anyone looking for cash on hand or to consolidate debt. The best thing to do with this type of refinance is have a drawn out plan with what you are...

Chris Prefontaine, Smart Real Estate Coach – Episode 140 ┃Inside Real Estate

Chris Prefontaine, founder and CEO of SmartRealEstateCoach.com and host of the Smart Real Estate Coach Podcast, is a 3-time best-selling author of Real Estate on Your Terms, The New Rules of Real...

Brandon Mulrenin, Brookstone Realtors – Episode 139 ┃Inside Real Estate

Broker/Owner at Brookstone Realtors & Real Estate Coach, Brandon Mulrenin. He's dedicated his life to helping Real Estate Agents all over the world with how they can become successful in selling...

6 Key Real Estate Stats – Market Update for February 2021

It's safe to say the real estate market endured through the ongoing pandemic. Considering everything, the market came out with record and unexpected numbers leaving experts in awe. Here are some key...

10 Most Popular Inside Real Estate Podcast Episodes from 2020

What makes an Inside Real Estate episode so popular? From views, likes, engagement, and traffic, these episodes made the Top Ten list for 2020. #10 - Marc Summers, AIME Episode Highlight: “40… we...

Kyle Desmond, Hall and Hunter Realtors – Episode 138 ┃Inside Real Estate

Kyle Desmond, a top producer at Hall and Hunter Realtors and an Hour Magazine All-Star, shares his expert information about these hot topics: home prices gain, job reports, and evictions. Watch now!...

Joe and Jon Angell, Angell and Company – Episode 137 ┃Inside Real Estate

CPA's and MSA's, Joe and Jon Angell share their master knowledge. With tax deadlines coming up in a few months and the effects of the current pandemic still lingering, these professionals have...

Tony Raffin, RE/MAX First & The Talk to Tony Show – Episode 136 ┃Inside Real Estate

Over the past three decades, Tony Raffin has made every real estate mistake imaginable, and in the process, he has closed over $1 Billion in sales. He's been featured in the Wall Street Journal as...

Divorce and Your Mortgage – Here Are Your Options

Divorce isn't easy and how to handle your mortgage is a challenge many couples face during the process. Having a co-owned home and joint mortgage during a divorce can easily leave you stressed. The...

Inside Real Estate – Sheel Sohal, KW Domain: Luxury Homes International ┃ IRE Episode 135

Our guest this week on Inside Real Estate, Sheel Sohal, is Keller Williams ranked #1 individual real estate broker representing clients and properties locally in the Metro Detroit market. Focused on...

Inside Real Estate – Omega Lending Group, 2020 Year In Review ┃ IRE Episode 134

Inside Real Estate is back and better than ever in 2021. It's safe to say there's a lot to recap from 2020 in the real estate world. Our founders here at Omega Lending Group talk about the year as a...

What You Need to Know About Different Types of Mortgage Lenders

There are many types of mortgage lenders out there. Depending on your needs and which loan option you are looking for, one may be better for you than the other. With endless companies to choose...

Inside Real Estate – Episode 133 – Barry Habib, MBS Highway

Barry Habib, Founder/CEO of MBS Highway, joined us for this week's episode. He offered his insight on 2020, shared his thoughts on the appetite for homes, inventory levels, and more. Watch now!...

Michigan Real Estate Agent Tips – Shane Parker, Community Choice Realty

In an effort to bring more voices to our blog and our customers, we will be periodically spotlighting insights from realtors around Michigan. If you're a real estate agent or expert in the space and...

Inside Real Estate – Episode 132 – Mat Ishbia, United Wholesale Mortgage

Mat Ishbia, President/CEO of United Wholesale Mortgage, joined us for this week's episode. He shared his thoughts on mortgage space right now, his future predictions, and more. Watch now! ...

Michigan Real Estate Agent Tips – Samantha Hillery, Motus Real Estate

In an effort to bring more voices to our blog and our customers, we will be periodically spotlighting insights from realtors around Michigan. If you're a real estate agent or expert in the space and...

Inside Real Estate – Episode 131 – Jon Hartzell, Detroit Rising

Jon Hartzell, Founder and Director of Development at Detroit Rising, was on the show this week. Jon has an unwavering belief in the growth of Detroit, and in 2016, he focused his energy and passion...

Inside Real Estate – Episode 130 – Dave & Kim Panozzo, The Panozzo Team

Our guests this week, Dave and Kim Panozzo, have been spreading their authentic and inspiring message as power players in the real estate industry and as leaders in their community since inception....

Inside Real Estate – Episode 129 – Andrew Pawlak, leadPops

Our guest this week was Andrew Pawlak, the CEO & Co-Founder of leadPops.com, a digital marketing software, consulting, and managed services firm in San Diego, CA. Andrew has worked with thousands of...

Your Mortgage & Home Renovations: What You Should Know

There are many options when it comes to utilizing your mortgage to secure funds for home renovations. You could simply adjust your personal finances and save up, but that could take a while and your...

Inside Real Estate – Episode 128 – Jason Frazier, Equity Prime Mortgage

We had Jason Frazier, Chief Strategy Officer for EPM, on the show. Jason is an award-winning marketer, strategist, and technologist with more than 20 years of C-Level expertise in marketing,...

Inside Real Estate – Episode 127 – Dylan Tent, Signature Sotheby’s International Realty

This week we had Dylan Tent, Heli Realtor of Signature Sotheby's International Realty on the show. Dylan left medical school in 2011, enrolled in a local flight school and earned his Commercial...

Inside Real Estate – Episode 126 – Thom Tillier, Brookstone Realtors

Thom Tillier is an experienced realtor, marketer, and negotiator. As a top producing agent, his goals include great communication and extreme client satisfaction. Thom has been recognized for his...

5 Dos & 5 Don’ts When It Comes to Selling Your House

While the market right now is moving fast, this can change overnight. Still, there are some general best practices to follow when selling your house. More importantly, there are a number of mistakes...

Inside Real Estate – Episode 125 – Jamie Cavanaugh, Amerifund

Our guest this week was Jamie Cavanaugh, the Chief Operating Officer of Amerifund Home Loans, Inc. With over 20 years in the mortgage industry, she has been on executive leadership teams and has...

Inside Real Estate – Episode 124 – Nick Bastianelli, eXp Realty LLC

Nick Bastianelli of eXp Realty joined us on this episode of Inside Real Estate. Nick is a rising star in Michigan real estate. He offered insight into one of the key aspects that drives success in...

7 VA Mortgage FAQs – What Veterans Need to Know

If you are looking to get a VA mortgage, you probably have some questions. With a life decision like this, you want to be as educated as possible to avoid mistakes along the way. The US Department...

Inside Real Estate – Episode 123 – Zack Jones, Mark Z Real Estate Team

We had Zack Jones, Realtor at Mark Z Real Estate, on the show. Since becoming a realtor and joining Mark Z Real Estate Experts in November of 2015, Zack has produced a career volume of $23,878,303....

Inside Real Estate – Episode 122 – Renee Lossia Acho, KW Domain

It was great having Renee Lossia Acho of KW Domain back on the show. Renee is consistently in the Top Producer ranks in Bloomfield (MI) year after year. She has generated over $450 million in real...

5 Home Design Trends Evolving During the Pandemic

The pandemic has changed multiple aspects of all our lives. From where we can and can’t go, to the common goods, like gloves and masks, we need on a regular basis. One thing that has truly evolved...

Inside Real Estate – Episode 121 – Omega Lending

Omega's Paul, Sal & Brad discuss UWM's merger with Gores Holdings in the latest Inside Real Estate episode. Watch now! Episode Highlight "Gores right, which is the company that...

Inside Real Estate – Episode 120 – Darren Peterfi, eXp Realty

On this Inside Real Estate episode, we had Darren Peterfi of Peterfi-Cantleberry Real Estate Team (eXp Realty) on the show. With over 25 years of experience in the industry, Darren is an expert in...

Home Equity vs. HELOC: What You Need to Know When Refinancing Your Mortgage

When you are looking to refinance your mortgage, you may be considering between a home equity refinance or a home equity line of credit (HELOC) refinance. Both offer pros and cons but ultimately,...

Inside Real Estate – Episode 119 – Nancy Robinson, Century 21 Curran and Oberski

On this Inside Real Estate episode, we had Nancy Robinson, the #1 Realtor at Century 21 Curran and Oberski in Royal Oak and in the Great Lakes Region, #12 in the United States and #17 in the global...

Inside Real Estate – Episode 118 – Mark Shaftner, Keller Williams

We had Mark Shaftner back on the show and he talked about how competitive the housing market is in the metro Detroit area, especially houses in the $200,000 to $400,000 price range, and much more as...

Inside Real Estate – Episode 117 – Brennen Clarke, Mark Z Real Estate Experts

Brennen Clarke, Digital Realtor at Mark Z Real Estate Experts, was on the show this week and talked about differentiating yourself from the competition by creating your own brand, how video...

5 Home Buying Tips So You Don’t Waste Your Time & Everyone Else’s

The process of buying a house can be overwhelming to many. While you might start the process with your dream home in mind, the reality is that your dream house might be out of reach given your...

Inside Real Estate – Episode 116 – Omega Lending, Live Refinancing Q&A Part 2

How do loan officers get paid? The Omega Lending team answered this and more during part 2 of the refinancing Q&A. Watch now! Episode Highlight "In the past loan officers would get...

6 Strategies to Consider When Refinancing Your Mortgage

When it comes to refinancing, sometimes it's not just about getting a lower monthly payment. There are many strategies you should consider in order to maximize the value of your mortgage refinance....

Inside Real Estate – Episode 115 – Omega Lending, Live Refinancing Q&A

With rates as low as they are, many home owners are looking at refinancing. The mortgage pros at Omega Lending Group offered a live Facebook Q&A to answer any and all refinancing questions....

Inside Real Estate – Episode 114– Debbie Bloyd, DLB Financial Services

With nearly 20 years in the mortgage space and licensed in Texas and Florida, we were excited to have Debbie Bloyd of DLB Financial Services and financial talk show "The Debbie Lewis Show" on this...

Inside Real Estate – Episode 113– Marc Summers, AIME

On this episode of Inside Real Estate, we sat down with Marc Summers, President at the Association of Independent Mortgage Experts (AIME). Marc spoke about AIME's mission to help the mortgage broker...

The 5 Primary Types of Private Mortgage Insurance (PMI)

You may need to pay for private mortgage insurance (PMI) if you’re applying for a conventional loan. PMI allows you, the buyer, to put less than 20% down when purchasing a home. This policy is meant...

Inside Real Estate – Episode 112– Mat Ishbia, United Wholesale Mortgage

We were very excited to have Mat Ishbia, President/CEO of United Wholesale Mortgage, back on the show. Mat addressed some of the events that have taken place over the past few weeks in the mortgage...

What to Expect After You Make an Offer on a Home

So you've made an offer on a home you would like to buy. That means you've been preapproved for a mortgage, you've found your real estate agent and you have selected a mortgage company that you...

Inside Real Estate – Episode 111– Omega Lending Group

The boys behind Omega Lending Group discuss the latest news in the mortgage space and industry drama that is taking place. Watch now!

Inside Real Estate – Episode 110– Barry Habib, MBS Highway

We kicked off our "Mortgage Masters Series" with Barry Habib, American entrepreneur, mortgage industry executive, and founder and CEO of MBS Highway. Barry offered a ton of market insight and...

Inside Real Estate – Episode 109 – Joe and Jon Angell, Angell and Company

CPA's and MSA's, Joe and Jon Angell, joined us on last week's episode of Inside Real Estate. We talked tax deadlines, stimulus checks, the stock market and more. Watch now! Episode Highlight...

6 Common Types of Mortgages & Home Loan Options

If you are thinking about buying a house, understanding the mortgage industry and the many types of “products” is extremely important. Since it is likely you will be paying long-term, you are going...

Inside Real Estate – Episode 108 – Christian Grothe, Max Broock Realtors

Christian Grothe of Max Broock Realtors joined us on this episode of Inside Real Estate. Christian talked about how some agents drop the ball and essentially set up the next agent for success, and...

How to Pick the Right Mortgage Company For You

Picking the right mortgage company is imperative if you want to avoid headaches during the mortgage application and closing process. It’s not the best idea to simply go with the first one you see or...

Inside Real Estate – Episode 107 – Nathan Nix, Omega Lending

It was great having US Marine Veteran and VA Loan Specialist, Nathan Nix, from Omega Lending on the show last week. Nathan explained the benefits of choosing a Veteran Loan Officer for a VA Loan....

Inside Real Estate – Episode 106 – Mark Shaftner, Keller Williams

We were excited to have our friend Mark Shaftner of Keller Williams back on the show. Mark gives his insight into today's market, explains how COVID-19 is affecting real estate inventory and more....

Inside Real Estate – Episode 105 – Omega Lending Group

On this episode of Inside Real Estate, the boys behind Omega Lending discuss how the housing market is continuing to thrive through today's crisis. Watch now!

8 Factors that Impact Home Values When Selling

Have you recently thought about selling your home? Want to know what gets factored into the price? The value of your home is impacted by many things. Pricing a home accurately is challenging....

Inside Real Estate – Episode 104 – Ali Berry, Quest Realty

We were excited to have Broker and Owner of Quest Realty, Ali Berry, on the show again. Berry talks about today's buyers and the chances of purchasing your dream home in the current market. Watch...